ClearTax Integration for NetSuite

A simple connector that streamlines the creation and tracking of e‑Invoices and e‑Waybills in NetSuite, helping businesses stay GST‑compliant while saving time, cutting errors, and removing manual effort. With everything managed in one place, teams can focus more on growth and less on compliance.

- SKU :PRNSNCI01

- Last Update :October 2025

- Support for :NetSuite, ClearTax

- Implementation time :8 Business Days

ClearTax Integration for NetSuite

Automated e‑Invoice & e‑Way Bill Management

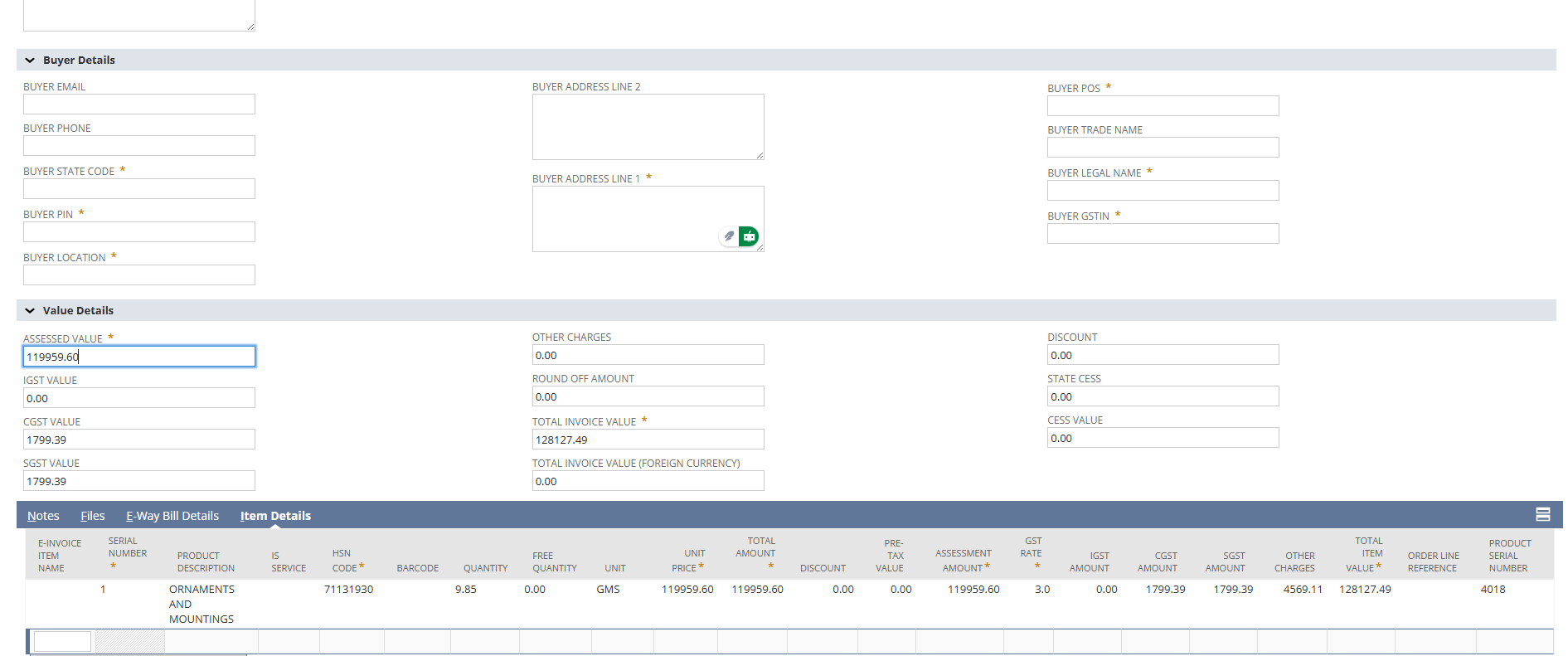

The automated e‑Invoice & e‑Waybill management for NetSuite offers a unified view of compliance activities, from invoice creation to shipment tracking. It simplifies complex GST requirements into clear, manageable steps that fit seamlessly into daily operations. By keeping data accurate and accessible, it reduces manual effort and prevents costly errors. The result is smoother compliance, greater efficiency, and more time for teams to focus on growth.

Simplify Tax Compliance for e‑Invoice and e‑Waybill in NetSuite

Documents are generated instantly within NetSuite, removing the need for manual entry. This ensures compliance tasks are completed on time and without unnecessary effort.

Update continuously to show which invoices and e‑Waybills are approved, pending, or need action. Teams gain clarity at a glance, reducing delays and uncertainty.

Information flows directly from source transactions, minimizing the risk of mistakes. By preventing errors early, businesses avoid penalties and shipment disruptions.

All compliance activities are consolidated in one place, making reviews simple and efficient. Leaders can quickly spot trends, address issues, and stay audit‑ready with confidence.

Compliance Prerequisites & Operational Guidelines

- E‑Invoice and e‑Waybill data must be accurately entered and maintained in NetSuite to ensure reliable compliance tracking.

- Only transactions processed and approved through NetSuite and Clear Tax are included; external or offline records are not captured.

- GST registration details and statutory information should be kept current in the system for smooth automation.

- Access rights should be managed so that only authorized users can generate, view, or modify compliance documents.

Turn Complex GST Rules into Simple Workflows

- Real‑time validation ensures every invoice and e‑Waybill meets GST requirements.

- Built‑in checks reduce the risk of penalties and last‑minute surprises.

- Routine compliance steps are handled instantly within NetSuite.

- Teams spend less time on paperwork and more time on high‑value work.

- Compliance data transforms into actionable insights for planning and forecasting.

- Leaders can identify trends, optimize processes, and stay audit‑ready with confidence.

- A shared dashboard keeps finance, operations, and compliance teams aligned.

- Everyone works from the same data, reducing miscommunication and delays.

Frequently asked Questions

All data is encrypted in transit and at rest, with strict role‑based access controls.

The system validates every invoice and e‑Waybill against GST rules in real time, flagging discrepancies instantly. This proactive error detection minimizes the risk of non‑compliance and costly penalties.

It’s built to handle high transaction volumes without slowing down NetSuite. If the GST portal is unavailable, requests are queued and automatically retried, ensuring no data is lost.

Yes. The compliance engine is continuously updated to reflect regulatory changes, so your business stays aligned with the latest GST requirements.

Provides complete transparency with real‑time status updates, audit trails, and exception reports. Every action from invoice creation to e‑Waybill approval is tracked and visible, giving businesses confidence and control during audits or internal reviews.